Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet. Book value per share represents the total amount of money the company would generate if the company were to be liquidated. Once you have the book value per share for each company, you can compare them to get an idea of the financial health of each company. Generally, a higher book value per share indicates that the company is in better financial health than a company with a lower book value per share. Investors should also consider the company’s historical performance when interpreting book value per share ratios. If the company has been consistently increasing its book value per share ratio over time, it may be a sign of a healthy and growing business.

- This represents the residual interest in the company’s assets after liabilities are deducted and includes common equity, such as paid-in capital and retained earnings.

- By using book value per share to analyze a company’s financial health, investors can gain valuable insight into the company’s current and future prospects.

- Also, as there is an increase in the book value per share growth of the company, the stock would be considered to be more valuable and the price of the stock would increase.

- However, it’s important to use book value alongside other metrics for a comprehensive analysis.

- The BVPS meaning in stock market is the sum that shareholders would get in the event that the company was liquidated after all liabilities have been paid and all tangible assets sold.

Step 2: Calculate the P/B Ratio

However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value. Market demand may increase the stock price, which results in a large divergence between the market and book values per share. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. Investors use journal entry for depreciation BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

Example of P/B Ratio Calculation

If the investors can find out the book value of common stocks, they will be able to figure out whether the market value of the share is worth it. The Management Discussion and Analysis (MD&A) section of annual reports often expands on these figures. Here, management explains factors influencing book value per share, such as share buybacks or new equity issuances. This section may also address industry-specific challenges or opportunities affecting the company’s tangible asset base, offering valuable context beyond the raw numbers.

During a merger, a baseline price for the common and preferred shares of the business being absorbed has to be calculated by both companies. Whereas, the book value per preferred share divides the applicable equity by the number of shares. Hence, a company’s book value per share calculation is done based on common shareholders’ equity in the company. The average number of outstanding shares is used most times because the amount at the end of a financial year may include a recent stock buyback or issuance which can skew the results.

Book value per share vs market value per share

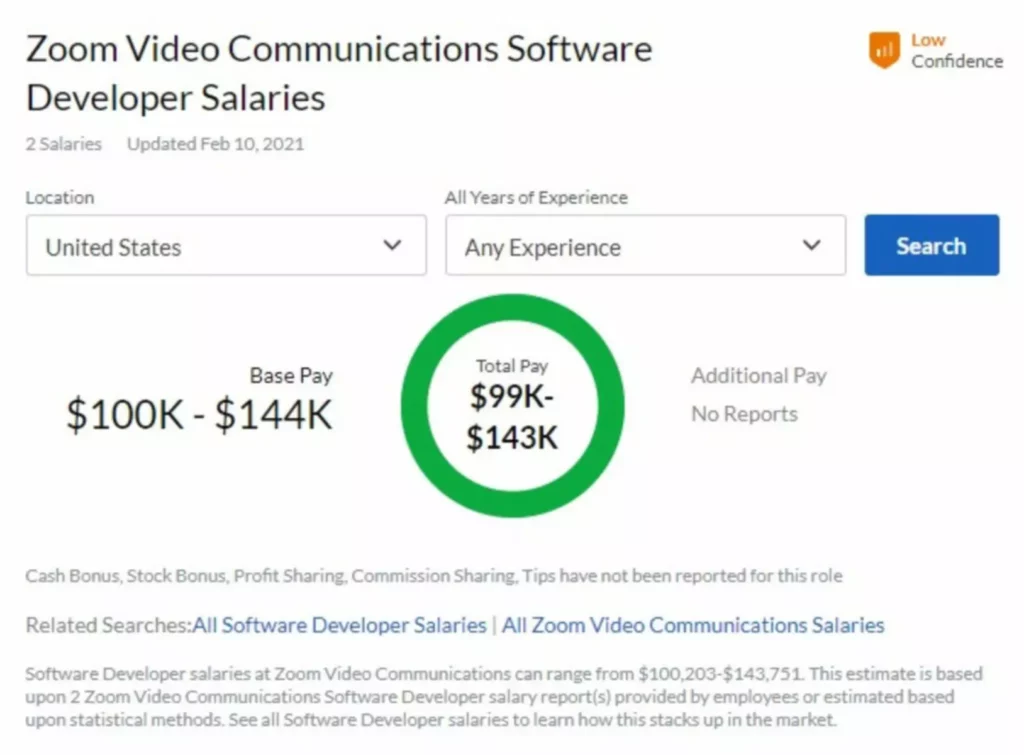

A good Book Value Per Share typically indicates that a company’s stock is undervalued if the Book value is higher than its current market price. However, what constitutes a “good” BVPS can vary by industry and should be compared with similar companies in the same sector. A lower P/B ratio might suggest the stock is undervalued, whereas a higher P/B ratio could indicate overvaluation.

Adjustments for Preferred Stock

Comparing book value per share across different companies is a great way to get an idea of the financial health of a company. Book value per quickbooks items share is a measure of a company’s net worth, or the value of its assets minus its liabilities. It is calculated by dividing the company’s total assets minus its total liabilities by the number of outstanding shares. Book value per share is a financial ratio that measures the value of a company’s assets on its balance sheet relative to the number of shares outstanding.

Equity Figures

For instance, a company with significant intangible assets might have a lower Book value, but this doesn’t necessarily mean it’s undervalued. Investors should consider other financial metrics and qualitative factors before making investment decisions. By understanding the book value per share of a company, you can make more informed decisions about investing in it.

Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding. For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash. In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS). The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding. The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. By calculating the book value per share for each company and comparing them, you can get a better understanding of the financial health of each company.

Hence, the market price per share is not fixed compared to the book value per share. Book value per share analysis involves taking the ratio of a company’s common equity divided by its number of outstanding shares. Hence, the book value per share interpretation effectively indicates a company’s net asset value (i.e. total assets – total liabilities) on a per-share basis.

Is BVPS relevant for all types of companies?

- Factors such as earnings retention, share buybacks, and asset management can impact the BVPS.

- For instance, company ABC can increase its BVPS by repurchasing common stock from shareholders.

- The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a company.

- For investors in India looking to identify hidden opportunities or understand a stock’s true worth, BVPS serves as a reliable compass in navigating the complexities of the financial market.

- If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases.

- Industries, financial conditions, and other company-specific factors influence what a “good” BVPS means in practice.

- Book value is good if one wants to get a better grip on the value of a company, based on its internal financials.

Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share. BVPS compares the amount of what is accounts receivable days formula and calculation stockholders’ equity to the number of outstanding shares. The stock price is considered underpriced if the market value per share is lower than the book value per share.

When a company initiates a buyback, it purchases its own shares from the market, reducing the number of outstanding shares. This reduction can lead to an increase in BVPS, as the equity is spread over fewer shares. The intention behind buybacks often includes signaling confidence in the company’s financial health or utilizing excess cash when other investment opportunities are limited. When calculating BVPS, one must account for preferred stock, which holds a distinct position in a company’s capital structure. Preferred stock typically carries a fixed dividend and priority over common stock in liquidation. This priority means that when determining equity available to common shareholders, the value attributed to preferred stock must be subtracted from total equity.

How does BVPS differ from market value per share?

Helen aims to ensure our community have a wealth of quality content to read and enjoy. This website is for informational purposes only and does not constitute financial advice. Users are encouraged to conduct their own research or consult a qualified professional before making any financial decisions.